When it comes to tax reporting, it’s highly important to be precise and comply with regulations. Businesses and self-employed individuals need to issue 1099 forms to report different types of income. However, even minor errors in these forms can lead to significant consequences. That’s why many people are turning towards technology to help them. One of the most popular tools for this is ThePayStubs’ 1099 creator. By utilizing this tool, individuals can simplify the complex process of generating accurate and compliant 1099 forms.

To effectively use 1099 form generators, it’s important to follow best practices. For instance, one should always double-check the information entered into the generator to ensure accuracy. Additionally, it’s essential to stay up-to-date with changes in regulations and tax laws that may affect the reporting process. By staying informed, one can avoid errors and potential penalties.

Overall, utilizing a 1099 form generator can make the process of tax reporting less daunting. By following best practices and being diligent, individuals can ensure that their 1099 forms are accurate, compliant, and error-free.

Understanding 1099 Forms

It’s essential to submit a 1099 form to the Internal Revenue Service (IRS) as it’s a crucial tax document.

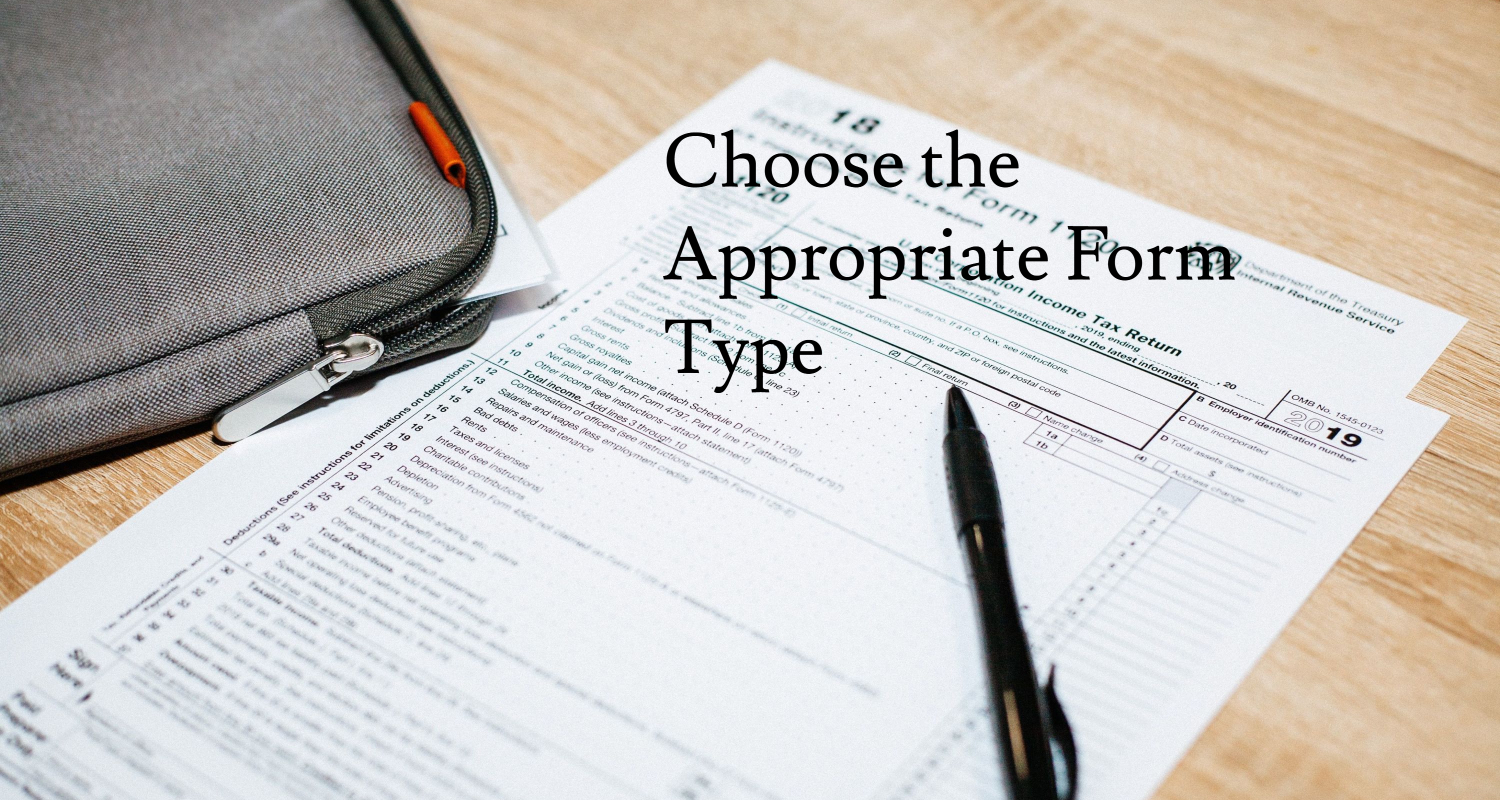

It is crucial to note that various forms, including 1099-MISC and 1099-NEC, are utilized for specific purposes. Businesses commonly use these forms to report payments made to contractors, freelancers, and non-employees. Moreover, failing to issue 1099 forms accurately and on time can result in penalties and legal complications. Therefore, it is essential to ensure that 1099 forms are issued accurately and on time to avoid any potential penalties or legal complications that may arise.

Advantages of Using 1099 Form Generators

Using a 1099 form generator has numerous advantages.

Here are some:

- Saves time and money while reducing errors associated with manual creation.

- Automation through a reliable generator like [1099 creator by “ThePayStubs”] reduces the risk of human mistakes and ensures consistency in form preparation.

- Additionally, such generators provide access to the latest tax regulations, which are vital for staying compliant with ever-changing laws.

- Businesses can customize the forms to match their needs, ensuring accuracy and relevance.

Best Practices for Using 1099 Form Generators

Research and Select a Reputable Generator

Before embracing a 1099 form generator, conducting thorough research is essential.

Reading reviews, seeking recommendations, and ensuring the generator complies with IRS guidelines are critical steps in making an informed decision.

Input Accurate Data

The generated forms’ accuracy hinges on the data input’s accuracy.

To make an informed decision about a generator, it is crucial to take certain steps into account. Firstly, it is essential to ensure that accurate data is inputted. This is because the accuracy of the generated form hinges on the accuracy of the input data. Furthermore, compliance with IRS guidelines is of utmost importance. Therefore, it is imperative to take the necessary steps to guarantee that the generator is compliant with these guidelines. By doing so, you can make an informed decision about the generator and ensure that it meets all the necessary requirements.

See Also: Top 2 Ways On How To Remove Compatibility Mode In Excel

Choose the Appropriate Form Type

Selecting the correct form type is pivotal. Different payments require different 1099 form types.

Adhering to IRS guidelines for proper classification and reporting is crucial to avoid errors.

Review Generated Forms Thoroughly

Even with automation, human oversight remains essential.

Before submission:

- Review the generated forms carefully.

- Look for errors in names, addresses, and payment amounts.

- Verify that the payment classifications are accurate and the calculations are precise.

See Also: Confirm Form Resubmission Error| 11 Quick Fixes

Stay Updated on Tax Regulations

Tax laws are subject to change, and ignorance of such changes can lead to non-compliance.

Regularly checking for updates and ensuring the generator incorporates the latest tax regulations is vital to accurate reporting. Also, if you do not know What Is A Tax File and How To Open A Tax File In Windows 10? Check out this.

Keep Records and Documentation

Maintaining copies of the generated 1099 forms and records of submissions and acknowledgments is advisable for compliance and accuracy during audits. You can also check out how to Repair Corrupted Excel Files.

You can also check out how to Repair Corrupted Excel Files.

FAQs

Is there a 1099 template in Excel?

You can download our 1099 NEC Excel Template to your computer and populate it using a spreadsheet program. Then, import it inside W2 Mate software to print and e-file your forms. Keep in mind that two mandatory fields require your attention. One is a text field with only a maximum of 11 characters. Let us help you make this process as smooth as possible!

What is the best software to print 1099s?

W2 Mate is the only software to generate secure PDF copies of PDF 1099 (recipient copies of form 1099 MISC / NEC) and secure PDF copies of W2 (employee copies of form W2). These PDF files can be sent electronically to the employees and recipients who have given their consent instead of sending paper copies.

How many copies of Form 1099 are made?

For each covered transaction, a Form 1099 must be completed by each payer. This includes making three or four copies: one for the payer, one for the payee, one for the IRS, and one for the State Tax Department if required. Payers who file 250 or more 1099 forms must e-file with the IRS.

How do I download a 1099 form?

To view your most recent tax form, sign in to your online account and head to OPM Retirement Services Online. You can find the 1099-R Tax Form in the menu. Select a year from the dropdown menu if you need to view tax forms from other years. Click on the save or print icon to download your tax form.

Conclusion

Generating accurate and efficient tax reports is crucial for responsible financial management. Therefore, this article outlines some best practices that businesses and individuals can follow to ensure compliance with tax regulations. Firstly, meticulous data input is vital to prevent errors in tax reporting. Additionally, proper form selection is crucial to ensure the correct form is used and all required information is included. Furthermore, a consistent review of the tax reports is required to spot any errors or discrepancies before submitting them. By adopting these best practices, preparing 1099 forms can become a reliable and seamless part of your financial operations.

See Also: Your Printer Has Experienced An Unexpected Configuration Problem